The Backdoor to Russian Gas

How Arbitration Awards Could Quietly Reopen the Pipelines Into Europe

The European Commission dreams of cutting off Russian energy for good. Eliminating Russian fossil fuel imports by 2027 was a goal declared in the adrenaline rush of early 2022. However, three years later, reality is punching back: gas flows are rising, not falling, and key member states are ignoring the script.

Despite the official narrative of decoupling, countries like France, Italy, and Spain increased their purchases of Russian gas in 2024. For industrial powerhouses like Leuna Chemical Park—one of Germany’s biggest chemical clusters hosting plants of Dow Chemical and Shell—and SKW Stickstoffwerke Piesteritz, ramping up gas flows even more is a matter of survival.

Now Brussels is trying to claw back control. On May 6, the Commission is expected to unveil a new roadmap to finally make the 2027 target stick.

First, it wants to block European companies from signing any new oil or gas contracts with Russian suppliers, including on the spot market. Then, it proposes giving those companies the legal authority to declare force majeure and walk away from existing contracts without paying penalties.

A price shock could be the result, as entire sectors would be forced to renegotiate their supply chains. Even now, the EU concedes that 19% of its gas imports still come from Russia.

The Commission can’t enact any of these measures on its own. They require unanimous approval from all member states, something that looks increasingly unlikely to achieve as Slovakia and Hungary are pushing back.

If all that weren’t messy enough, Politico reports the White House is now discussing whether to lift sanctions on key Russian energy infrastructure, including Nord Stream 2 and Arctic 2 LNG:

There is an internal White House debate between the energy dominance people — Burgum, who wants markets for U.S. LNG — and Witkoff, who wants to be closer to Russia.

While it’s impossible to predict how these internal skirmishes will unfold, one thing is clear: NS2 is a unique asset. A few weeks ago, I argued that it’s far too valuable to abandon and that a new owner will likely push out the old investors in bankruptcy and scoop it up for pennies on the dollar.

But it turns out, it’s not just the pipeline that matters. There’s a legal subplot unfolding, one that could tip the balance even further toward a renewed surge of gas. Let’s unpack it.

👀 Reading this from a forwarded email? You’re missing critical insights while others act faster. Subscribe to The Brawl Street Journal, it’s free…

Billions Awarded, No One’s Getting Paid

After Russia’s 2022 invasion of Ukraine, Gazprom sharply curtailed or cut off gas deliveries to a long list of European energy companies. In response, several of those firms turned to arbitration. They want compensation for undelivered volumes and the emergency purchases they had to make at sky-high prices. Some of those cases are now bearing legal fruit:

In June 2024, Uniper (Germany)—once one of Gazprom’s largest customers—won a landmark €13 billion award from a Stockholm tribunal. It covers undelivered gas since mid-2022. Uniper was able to offset about €530 million (an unpaid bill from August 2022), but how much of the remaining €12.5 billion it will ever collect remains unclear.

OMV (Austria) won €230 million plus interest. Instead of waiting for payment, it enforced the award directly by deducting the amount from what it owed Gazprom under an existing contract. Gazprom responded by cutting off gas flows to OMV in November 2024.

CEZ (Czech Republic) secured a €42 million award. A smaller case, but part of the same trend: tribunal-validated losses.

RWE (Germany) launched arbitration in late 2022 for €2 billion. RWE reported in March 2025 that it prevailed.

More claims are still pending. Engie (France) is also pursuing damages, likely in the hundreds of millions, while Italy’s Eni is in similar talks, though details remain private.

Billions in awards are now on the books. But sanctions, capital controls, and political reality make one thing obvious: Gazprom isn’t going to pay in cash. For these companies and their shareholders that’s obviously a problem.

The Legal Duty to Collect

Start with Uniper. Its €13 billion award amounts to more than 70% of its current market cap. 99% of the company is now owned by the German state, which might be willing to eat the loss if repayment gets complicated. But not every claimant is nationalized.

Take RWE. Its €2 billion claim represents about 7% of its valuation. That’s a substantial amount of cash. And it comes with a fiduciary obligation: if there’s a valid award on the books, management has a legal duty to try to enforce it.

These are real balance sheet assets and investors will expect real action to recover them. Whether by cash, offset, or some other form of settlement, they’re not going to sit there while Gazprom shrugs off its liabilities.

This fiduciary duty creates a sanctions off-ramp. How? Ancient Chinese military stratagem 21 offers a clue.

“Slough Off the Cicada’s Shell”

When the cicada outgrows its body, it leaves behind a perfect replica, an empty husk. To predators, it still looks like the cicada. But the real insect has already moved on.

That’s how Europe can preserve the appearance of weaning itself off Russian energy, while resuming the flows. Here’s the trick: reframe the gas not as a purchase, but as debt repayment.

Billions are owed. Arbitration awards must be honored. Politicians aren’t reversing course, they’re enforcing contracts. The EU keeps the façade intact.

The shell is sanctions and phase-out targets. The cicada is gas molecules flowing westward again. It’s a legal workaround masking a strategic retreat. “Look, we’re not buying new gas from Russia, we’re forcing them to meet their legal obligations. It’s just debt enforcement!”

This isn’t a fringe theory. It’s already being floated by one of Europe’s most senior energy executives.

According to Reuters, Didier Holleaux, Executive Vice President at France’s Engie, suggested that Gazprom could send gas to meet its arbitration debts.

Once that begins, the rest follows: pipelines need pressure and industrial customers want continuity. Politicians let “temporary measures” become permanent. Back to a new, old normal.

All of this hinges on a simple question: Would Gazprom play along? The answer is almost certainly yes.

Stranded Molecules

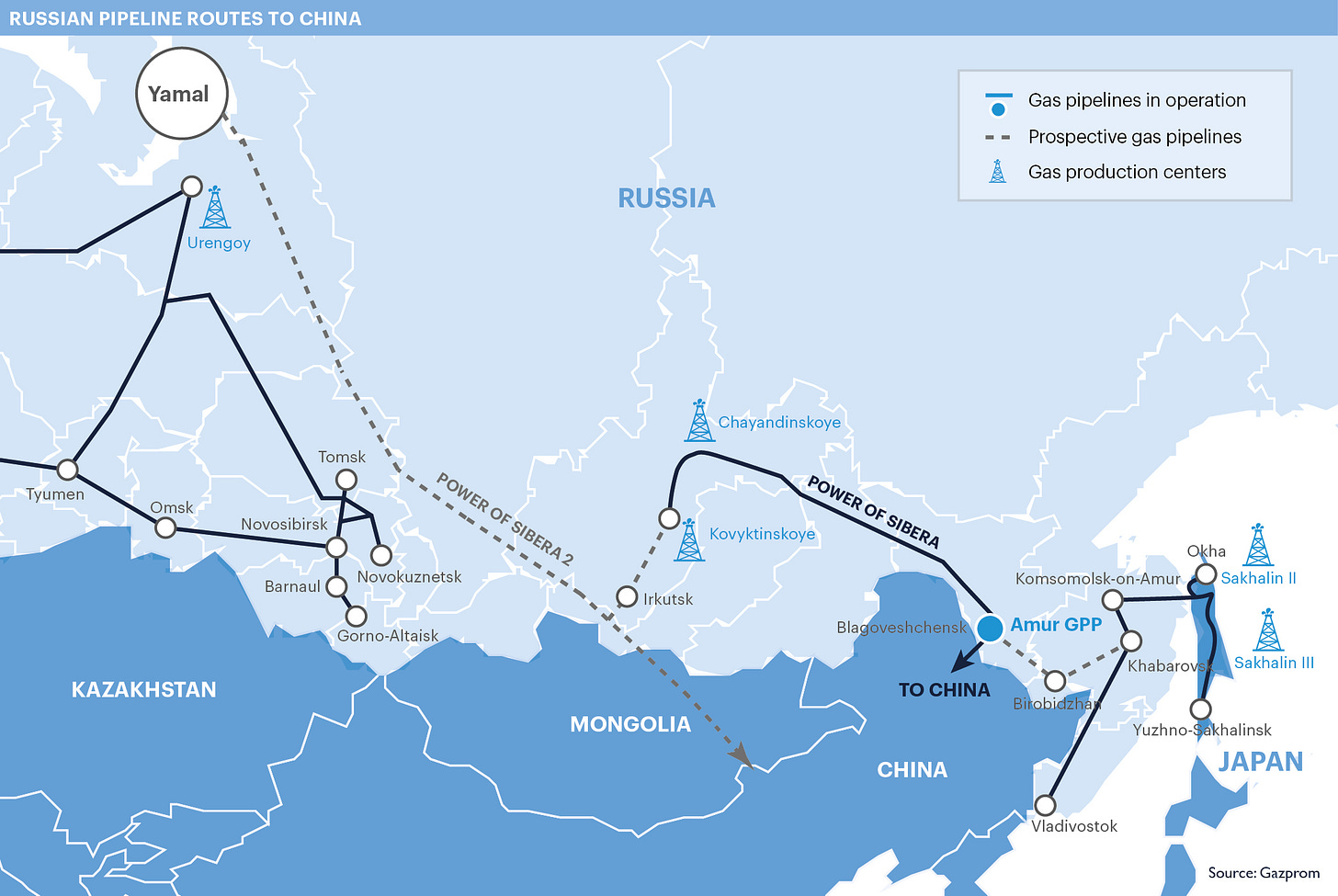

The gas in question is stranded. Russia would love to pivot eastward, but the infrastructure isn’t ready. The proposed Power of Siberia 2 pipeline, meant to carry gas from the Yamal Peninsula in Western Siberia to China, is stuck in negotiation limbo. Beijing, well aware of Moscow’s weakened bargaining position, is reportedly demanding steep discounts and strict supply guarantees. The Kremlin sees the terms as unacceptable. As a result, the project has stalled.

If you understand how stranded gas behaves in commodity markets, the implications are clear.

In the U.S., the Waha Hub in the Permian Basin shows what happens when production outpaces takeaway capacity. Gas prices there have gone negative for extended periods because producers have no viable way to move the gas. The same logic applies here. There’s no price flashing red on a trading screen but the economic value is already negative.

In that context, Gazprom has only one option: send gas westward to offset arbitration awards. Doing so allows the company to regain both a foothold in its most lucrative historical market and cash flow. It may not have much choice. In 2024, Gazprom reported a net loss of $12.9 billion, its worst result in decades.

In fact, gas is one of the few valuable assets Gazprom still holds in Europe. Its international footprint shrank after the nationalization of Gazprom Germania at the height of the energy crisis. Moreover, arbitration awards are enforced on a first-come, first-served basis. For EU companies, accepting gas makes far more economic sense than fighting over the few remaining assets outside Russia they might still access.

And that’s not the only reason why cutting energy ties to Russia is unlikely going to happen.

No Backup Plan

If you take a step back, the Commission’s new energy plan makes little sense, even by its own standards. The EU’s strategy documents all repeat the same mantra: “A key part of ensuring secure and affordable supplies of energy to Europeans involves diversifying supply routes.”

But real diversification means adding suppliers, not subtracting them. Yet, Brussels seems intent on cutting out one of its historical largest suppliers, without securing equivalent alternatives.

And it gets even more awkward when you apply the EU’s own ideological lens.

If buying gas from Russia is a moral problem, then buying gas from the United States, especially under a Trump presidency, can hardly feel like a triumph either. After all, “Orangeman bad” is Brussels’s political doctrine.

Trump’s tariffs and disdain for multilateral institutions sit uneasily with the EU’s political class. A bigger dependency on the U.S. is exactly what the EU wants to avoid, especially with no trade deal in sight. Polymarket gives a near-term U.S.-EU trade deal a 34% chance. Hardly the basis for a new energy alliance.

Yet, a deeper U.S. dependency is exactly what the Commission’s proposed scheme demands: Abandon Russian molecules, then become even more reliant on American ones. It’s why the Commission’s new plan is doomed from the start.

A Face-Saving Detour

The pressure points are too painful: a struggling industrial base that needs cheap gas, and a diversification doctrine that collapses the moment it limits options instead of expanding them.

Many member states will welcome Russian molecules back, regardless of the Commission’s insistence on speeding down the energy highway on the wrong lane. This won’t necessarily mean a return to pre-war volumes. But it’ll be a far-cry from the Commission’s wish to get rid of Russian energy altogether.

The way to get there? The cicada stratagem: a face-saving legal off-ramp disguised as enforcement. Arbitration becomes diplomacy. Debt payments become delivery. The cicada leaves its shell, the pipelines refill, and Europe finds its way back to the supplier it swore it had outgrown. After all, reality moves faster than ideology.

Send this to anyone still pretending the EU has an “energy strategy!”

People in boardrooms, energy desks, and hedge funds keep forwarding this. Stop getting it late — subscribe now!

Already subscribed? Thanks for helping make BSJ quietly viral.

Europe will continue to slide in to energy poverty until they just fess up and admit they need Russian gas. This is a scheme to save face but it will not be enough to save the industrial base. They need it now and for as long as they want to survive. The wind and solar schemes won’t make the petro chemicals and thousands of other derivatives from gas that are consumed in everyday life. The pie in the sky dreams are going to turn in to nightmares if they don’t wise up.

Its farcical to what extent EU tries to wrangle European economies, which, by hook or by crook, will get Russian gas switched back on because, what is the alternative? As unenviable as it is, Europe has to recon with its ideological hangups and admit that without Russia, there's no going anywhere. The problem they have is that the US is not going to back them up at a drop of a hat as it used to. The entire strategic outlook needs reviewing.