After years of Brussels preaching the virtues of a “rules-based order,” China’s recent rare earth elements (REE) export curbs feel like a thinly veiled “eff you.” Its justification for the restrictions is a textbook case of screwing someone over while claiming to follow the rules.

Officially, China cites national security concerns and international nonproliferation obligations. In line with this, REE exporters must now obtain individual licenses for each shipment. This process demands extensive documentation, including factory photos, product composition, end-use, and end-user details. The stated goal is to ensure materials don’t end up in military applications.

With true bureaucratic sadism, approvals crawl at a glacial pace. Between April and late June 2025, only about 25% of applications had been approved, creating major supply chain disruptions for both U.S. and EU firms.

The real motive is, of course, retaliation for Trump’s tariffs, with the EU getting caught in the crosshairs. Maybe China hopes Brussels will pressure Washington. Or maybe it wants to show Europe how easily “non-discriminatory” rules can be used to humiliate a continent that insists on their superiority. Either way, the pain is real.

Magnets That Bind

The EU sources virtually all of its imports of the targeted REE from China. These elements power the magnets inside electric motors and generators, from washing machines to missile guidance systems. An F-35, for example, contains more than 400 kilograms of REE.

Europe’s green tech dreams are also built on China’s REE and the sectors feeling the pressure most acutely are EVs and wind turbines. The European Association of Automotive Suppliers (CLEPA) reports, China’s restrictions initially forced the shutdown of several production lines. While approval rates jumped to around 60% in late June, CLEPA says Beijing is still approving the bare minimum, just enough to avoid further stoppages.

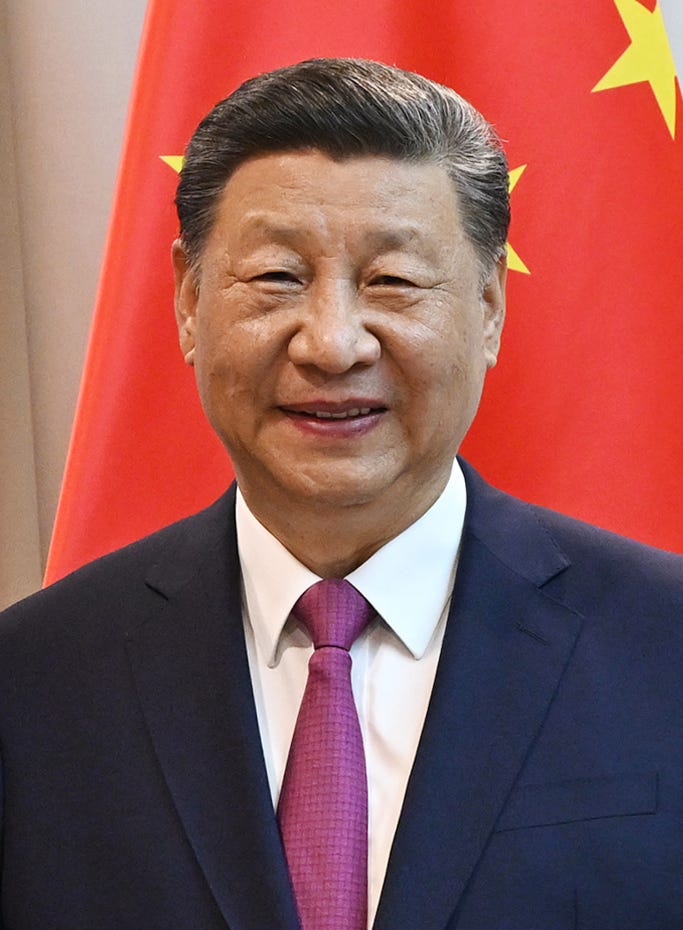

It isn’t surprising Ursula von der Leyen told the G7 that China is engaging in “blackmail” and urged investment in non-Chinese “extraction projects and processing capacity.” But Europe’s real mistake isn’t underfunding a domestic REE industry. It’s over-reliance in the first place. Let’s unpack why the EU’s green agenda makes it vulnerable and what a smart industrial strategy might look like.

👀 Reading this from a forwarded email? Subscribe to The Brawl Street Journal to get it straight from the source…

A China Addiction

When a critical input becomes scarce or politicized, the most prudent first step is to reduce reliance, either by finding substitutes or by changing strategic direction altogether.

That’s easier said than done, but progress is visible. BMW, for instance, eliminated REE from its EV drivetrain by adopting an Externally Excited Synchronous Motor, which generates a magnetic field using electricity instead of permanent magnets. While this design draws more power from the battery, it doesn’t seem to have hurt BMW’s popularity: in Q1 2025, the company reported a strong uptick in global EV sales.

In other areas substitution is far less viable. Offshore and next-generation onshore wind turbines remain heavily dependent on REE, and demand from the wind sector alone is projected to rise fivefold by 2030.

REE make up just 1% of a wind turbine’s weight but according to Columbia Business School, they account for 25% of the cost. So when REE prices spike, the impact is brutal. That’s a massive problem for turbine manufacturers. Even during the boom years between 2016 and 2020, most European producers operated with single-digit profit margins. According to the Global Wind Energy Council, more than half of the Western turbine suppliers saw negative year-on-year profit growth in 2024. Spanish-German wind turbine maker Siemens Gamesa even posted a €1.7 billion full-year loss that year.

The writing is on the wall. Most of these companies will stop making turbines or shut down altogether. The vacuum will be filled by Chinese firms, just like it was in solar and batteries. In other words, Europe’s dependence will evolve. Instead of relying on China for raw materials, it’ll depend on it for the finished product. And because wind turbines, solar panels, and batteries all have a shelf life of about 20 years, this is a permanent subscription. China’s REE curbs are just the foreshock of this tightening grip. If you zoom out, the situation feels familiar. Europe has been here before, during the oil crisis of the 1970s.

The Last Time This Happened

France's electricity generation heavily relied on oil. But instead of trying to out-negotiate OPEC or waiting for supplies to rebound, it changed course entirely by launching one of the boldest nuclear buildouts in history. Within a decade, France went from importing the vast majority of its energy to producing over 70% of its electricity from nuclear power. Today, it still enjoys some of the cheapest, most stable electricity in Europe.

Europe faces a similar fork in the road now. It can either keep pretending that green tech dependency is somehow different from fossil fuel dependency, or it can learn from the past and make strategic choices that might hurt today but pay off for decades.

Of course, even if Europe course-corrects and dials back its green energy dogma by scrapping EV quotas and ending wind mandates (unlikely, I know), the REE problem doesn’t go away entirely. These materials are still vital for other sectors: defense, advanced electronics, industrial automation. Which is why Europe needs a second track: a strategic shift that keeps domestic and allied producers alive when China tries to wipe them out. To determine the right course of action, we first need to see how China plays the REE blackmail game.

Crushing the Market

In 2010, China cut off REE exports to Japan during a diplomatic standoff, triggering a price explosion. Cerium oxide, a major REE compound, jumped from $4.70/kg to $36/kg in six months.

A price spike is always a chance to turn previously unprofitable ventures into viable businesses. That’s what happened with Molycorp, the owner of the only REE mine in the U.S. As prices looked favorable, it tried to build out the first U.S. “mine-to-magnet” supply chain. But when China flooded the market with cheap REE again, the plan collapsed. Unable to compete, Molycorp filed for bankruptcy in 2015.

That story could easily repeat in Europe. Neo Performance Materials launched the continent’s first “mine-to-magnet” supply chain in Estonia this May. With China choking supply, customers are willing to pay a premium for its magnets. Some even see it as a cost-saving move: better to pay more than shut down a factory for a month. But if China floods the market again, the Molycorp playbook could unfold all over again.

To see why this keeps happening, you have to understand the scale and ruthlessness behind China’s REE machine.

China’s dominance in rare earths stems from a mix of advantages: strong government backing, surface-level deposits with low radioactivity, favorable mining conditions, cheap labor, and unusually high concentrations of rare earth elements, especially the more valuable heavy REE, which are harder to find and critical for high-performance magnets. (Light REE like neodymium and cerium are more common and used in bulk applications, while heavy REE such as dysprosium and terbium are scarcer and essential for advanced tech.)

After the Soviet Union collapsed, China also acquired rare earth technology and talent by absorbing specialized equipment and recruiting former Soviet chemists, engineers, and designers. Cornering the REE market isn’t just a state strategy. China’s companies play dirty too. As mining analyst Hallgarten + Company explains:

Chinese companies, to their credit, have more than taken advantage of the advantages provided, and now they are absolute and uncontested leaders in the field of REE. They use all possible means to consolidate their leadership and prevent the development of REE technologies in other countries. To do this, they use various technical and economic techniques: they buy even low-quality REE concentrates (with a high content of the light group and a low content of the heavy group) and even at inflated prices, dump prices on the global REE market, introduce additional quotas and restrictions on the sale of both REE in the form of oxides or metals, and their compounds for the purposes of political and economic pressure.

So when a company as exposed to China’s brutal games as Neo Performance Materials decides to set up shop in Europe, despite the odds stacked against it, what should policymakers do to help it survive? Let me propose a practical solution.

Stop Begging, Start Deterring

What’s needed is a strategic guarantee that shows China’s power plays will fall flat. This could take the form of a strategic procurement facility. Essentially, the EU could act as a buyer of last resort for rare earths sourced from Europe or allied countries. The goal is to keep critical supply chains alive when Beijing floods the market to kill them. By offering long-term offtake guarantees at benchmark-linked prices, the EU can ensure producers don’t fold at the first price dip.

Designing such a mechanism won’t be easy. It needs strict quality controls, transparent eligibility criteria, and safeguards against abuse. But here’s where this idea gets really interesting: Europe might never have to buy a single kilogram under the scheme. Its mere existence has the potential to signal to China that dumping the market won’t work next time. It’s deterence against economic blackmail.

This two-sided strategy — (1) cutting rare earth dependence in the energy sector and (2) effectively shielding European producers against Chinese market manipulation — is nothing that's widely discussed. But without it, the EU’s talk of “strategic autonomy” rings hollow. Its current response to economic coercion is sending diplomats to grovel for more shipments. Let’s call this what it is: surrender. The longer it drags on, the more humiliating it becomes.

Send this to anyone claiming green energy = autonomy!

📨 People in boardrooms, energy desks, and hedge funds keep forwarding this. Stop getting it late — subscribe now!

Already subscribed? Thanks for helping make BSJ quietly viral.

In late 2008 it was announced that Hemlock Semiconductor was planning to spend up to $2.5 billion to build a facility to manufacture polysilicon in Clarksville, TN. Polysilicon is the foundation for solar panels. The facility was built, and a lab was built at nearby Austin Peay University to train workers. The plant was built, workers were hired and trained and pilot production began. In late 2014 it was announced that the plant was closing - what happened? China cut the price of polysilicon below Hemlock’s (and others) price of production, competing suppliers folded giving China a near monopoly on polysilicon below Hemlock’s silicon.

China is playing the same game with REE, and the U.S. has its head in the same noose as the EU. Attempts to mine REE in the U.S. face opposition from environmental groups, and obtaining permits to refine REE concentrates face stringent EPA permitting process and more opposition from environmental groups.

China’s REE & polysilicon policies are just a facet of China’s mercantilist policies, attempting to coerce the world into purchasing higher value added products from China by controlling the supply of critical raw materials. Additionally, control of critical materials used in defense applications through end user certification gives China visibility & control over the wests defense modernization efforts.

The west needs a unified response to Chinas aggressive mercantilist policies, certainly subsidizing non-China producers is one approach. Another is to use tariffs to set a floor on the price of China’s raw material & higher value added products utilizing critical materials to eliminate any competitive advantaged gained through this behavior. This would give non Chinese suppliers assurance that they won’t face getting cut off at the knees by a Chinese trade war.

The west also needs to find a happy medium between environmental protection and the production of the raw materials required by a modern industrial economy. It does the world no good to have some countries environmental controls force production to some other corner of the world having minimal to no environmental protection.

Your Sunday articles are always some of the best of the week, thank you. Rare Earths are going the way of every industry China wanted to conquer. Going back 20 plus years I have observed these industries but I’m sure it’s much deeper. Steel, mid, low end semiconductor manufacturing, high tech manufacturing ( iPhone, many electronics, solar panels), now a major play to control rare earths, that is a major power grab against the world, except we’re not really paying attention to the consequences imo.