“The use of mixers like the Tornado Cash immutable smart contracts is, well, mixed.” – United States Court of Appeals for the Fifth Circuit

Something incredible happened last week. Sanctions imposed by the US government on the cryptocurrency service Tornado Cash were overturned by an appellate court. The decision triggered a surge of Tornado Cash’s native token, TORN, which jumped from $3.50 to a brief peak of $35.

Of course, crypto enthusiasts found the court’s decision incredible. As Coinbase’s Chief Legal Officer put it, “this is a historic win for crypto and all who cares (sic) about defending liberty."

But what might be really incredible is the blockchain crowd’s eagerness to believe a new golden age of crypto paradise is upon us.

This represents a watershed moment for the cryptocurrency industry. For the first time, a federal appeals court has acknowledged that certain decentralized protocols operate entirely as something completely different from traditional property or businesses.

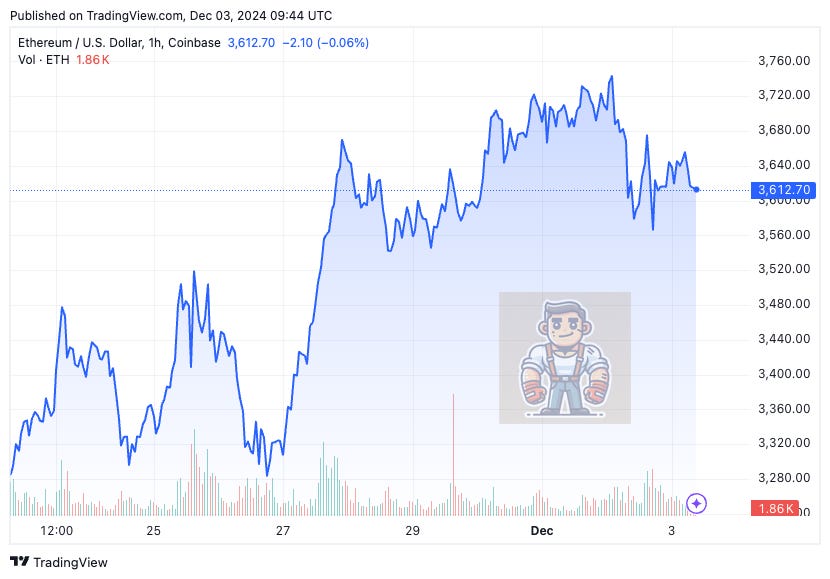

It wasn’t just a few commentators who got overly enthusiastic. The entire market got carried away. Again, TORN briefly surged 10X, while Ethereum rose about 10% after the decision was issued on November 26 (Tornado runs on the Ethereum blockchain).

If you have no idea what Tornado Cash is and why the government might really hate it, let me give you a quick run rundown.

How does Tornado Cash work?

Cryptocurrency transactions are recorded on a blockchain – a public ledger that records all transfers. These transactions are pseudonymous. Only the wallet owner typically knows the transaction is his or hers. But de-anonymization is not impossible. Once you match a public address to a person, you can trace their entire transaction history.

Tornado Cash is a protocol that makes transactions on Ethereum private. You first deposit crypto into a “pool” smart contract. You then receive keys to withdraw the same amount from a given pool. When a critical mass of users participates by depositing and withdrawing their crypto, the transfers are mixed (hence the name “mixer”), making it extremely difficult to trace individual transactions, effectively anonymizing them.

Why does Tornado Cash draw the government’s ire?

The Treasury Department might describe Tornado Cash more succinctly: dirty money in, clean money out! That’s perhaps an unfair generalization, as you’ll see in a moment – but not entirely without basis.

After all, mixers are go-to tools for criminals to launder money. Nearly a quarter of funds sent to mixers in 2022 were tied to money laundering efforts. To quote from the court’s decision:

North Korea, through one of its cybercriminal organizations known as the Lazarus Group, has hacked and stolen just shy of one billion dollars’ worth of cryptocurrency. And all of that dirty money needed to be laundered before it could be cashed out for traditional (and far more liquid) fiat currencies. So North Korean hackers turned to mixers. More than 65 percent of North Korea’s dirty crypto went through mixers in 2021, “up from 42 percent in 2020 and 21 percent in 2019.” And how does North Korea use this laundered money? To fund its weapons of mass destruction and ballistic missile programs.

That’s why the Treasury Department’s Office of Foreign Assets Control (OFAC) issued a designation that included 53 Ethereum addresses associated with smart Tornado Cash contracts. In doing so, it blocked “all real, personal, and other property and interests in property” of the designated Tornado Cash entity.

Six Tornado Cash users went to court to challenge the designation. All of them apparently used it for legitimate reasons:

Plaintiff Tyler Almeida used Tornado Cash to anonymously donate to the Ukrainian war effort because he was worried that Russian hacker groups would target him specifically if they were able to easily trace the donation back to him. Plaintiff Kevin Vitale turned to Tornado Cash after learning that someone had linked his crypto activities to his physical address. Plaintiff Alexander Fisher used Tornado Cash to develop code that improved the uses of the Ethereum blockchain network. And plaintiff Nate Welch used Tornado Cash to protect his privacy and to avoid harassment from malicious actors.

Has the tech utopia come true?

In effect, the appellate court said the plaintiffs did nothing unlawful by using Tornado Cash.

Here’s the decision’s key section that makes the crypto crowd go crazy:

The immutable smart contracts at issue in this appeal are not property because they are not capable of being owned.

Crypto News claims the court acknowledged, “protocols operate entirely as something completely different from traditional property or businesses.”

As Crypto News goes on:

The ruling effectively creates a safe harbor for truly decentralized protocols that cannot be modified or controlled. While OFAC can still sanction individuals and companies, it cannot sanction the underlying code itself – at least under current law.

Sounds like a tech utopia has come true, right?

Not exactly. The court didn’t claim that code is some kind of magic “safe harbor” that’s automatically out of the government’s reach.

It simply ruled that OFAC overreached its statutory authority. While OFAC argued that smart contracts qualify as “property” under the sanctions regime, the court disagreed. It stated the term “property” cannot be interpreted in a way that covers smart contracts.

In other words, it merely upheld the rule of law and the separation of powers. Legislating is the job of Congress, not the administration or the courts. If lawmakers want smart contracts included in the sanctions regime, they have to pass the necessary laws. Most importantly, they can pass such laws.

The court even emphasized “the real-world downsides of certain uncontrollable technology falling outside of OFAC’s sanctioning authority.”

But apparently, not everyone in crypto land seems to acknowledge that fact.

Bill Hughes, senior counsel of Consenys (a blockchain company), says:

I actually think under a Trump administration, it’s more likely that this opinion will be adopted as Treasury policy.

Huh? Does Mr. Hughes really think that a Trump administration will allow hacker groups to funnel hundreds of millions to North Korea just because they use coin mixers? Seems like wishful thinking.

Trump loves to threaten other countries with sanctions. Most recently, he threatened sanctions against BRICS if they create a new currency. Any loophole for circumventing sanctions will almost certainly be closed.

But it’s just a tool!

The court likened Tornado Cash’s code to a tool used for pooling and mixing Ether. But, of course, you can regulate tools. Imagine someone builds a device capable of unleashing great harm if used by bad actors (such as financing terrorism, narcotics trafficking, ransomware, identity theft, fraud…). An administration cannot allow such a device to remain available. It will shut it down, even if there are legitimate use cases for it.

Keep in mind that nearly a quarter of the funds sent to mixers in 2022 were linked to money laundering. No administration, not even Trump’s, will say, “Yeah, that’s bad… but privacy!”

And it’s not just about banning the use of Tornado Cash. You can take it one step further. Can anybody who participates in the Tornado Cash protocol be charged with conspiracy to facilitate laundering? After all, you need a critical mass of users to make mixers work.

raised this point back in 2021.If I were a crypto trader, I’d short TORN now.

If you enjoyed this piece, please do me the HUGE favor of clicking the LIKE button!

Great crypto article on Tornado Cash.

This was a good decision by the Court of Appeals. It seems that now that SCOTUS has overturned the Chevron doctrine, lower courts are now much more likely to tell agencies to stay within their congressionally defined swim lanes.

But as you said, it will be interesting to see what Congress and the new administration will do.

You neglect to mention the widespread fiat laundering aided and abetted by the biggest coin tumbler of all time - the FED.