Breaking Point

The Coming Collision of Fiscal Reality and Climate Ideology

Markets aren’t panicking over France because they trust it, they’re calm because they know Germany can’t afford another breakdown. In past crises like Greece, Berlin demanded austerity. This time it dares not, even as its own economy bleeds: Germany is heading for a third consecutive year of contraction and facing a job massacre, with about 250,000 positions already lost and counting.

The last thing Berlin will risk is a eurozone fracture, no matter whether it’s Macron or Marine Le Pen’s National Rally at the helm in the coming weeks. Both Berlin and Paris will be happy for the European Central Bank to step in: buying French debt, stretching its mandate, and socializing the losses across the bloc.

But each wave of “stability” transfers more fragility onto Germany’s balance sheet. That’s where the ripple effects begin. The next eurozone crisis won’t just test Europe’s finances. It will expose the limits of its energy transition.

Because Germany can’t simultaneously bail out France, fund its rearmament, and underwrite the green transition. Fiscal space is finite and physics doesn’t accept IOUs. Yet Brussels insists renewables are cheap and the way forward. That message spreads easily because it feels intuitive: wind and sun are free.

That intuition is obviously misleading. What isn’t free is integrating them into an industrial economy and that cost doesn’t rise in step with capacity, it rises disproportionately.

That’s where intuition fails us a second time. We live in a mostly linear world: we age one year at a time, cover distance in steady motion, and see daylight return in predictable cycles. Non-linear growth is rare in daily life, which is why we underestimate it. But that curve becomes obvious in the cost of managing a grid saturated with renewables. Let’s see what happens when reality crashes into the green narrative.

👀 Reading this from a forwarded email? Subscribe to The Brawl Street Journal to get it straight from the source…

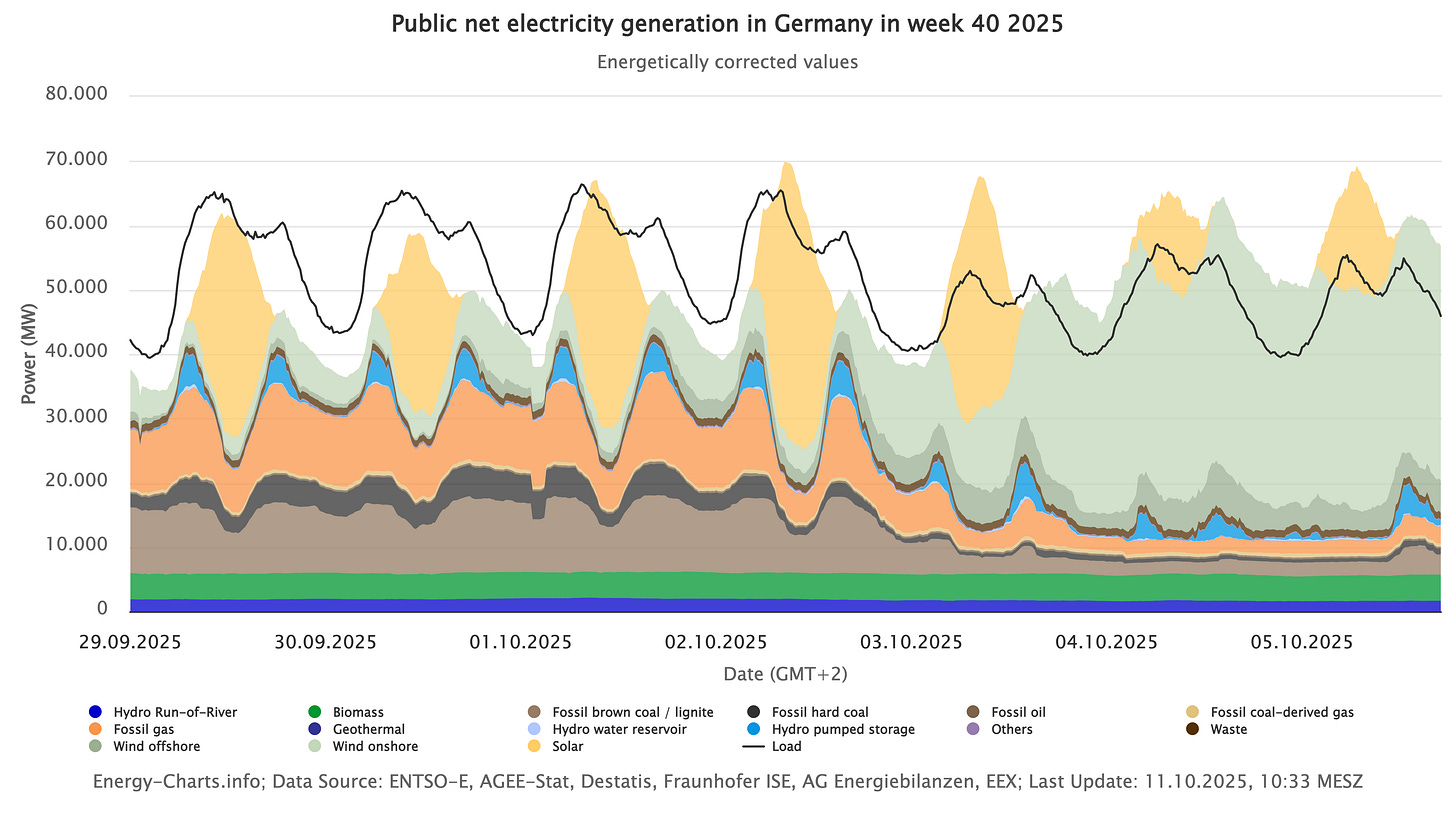

The grid runs on balance. At every moment, supply must match demand, no more, no less. Baseload plants like nuclear or coal run steadily. Dispatchable sources like gas and hydro adjust output within minutes to smooth short-term swings. Together, they keep the system in sync.

Intermittent power breaks that symmetry. Wind and solar respond to weather, not demand, and their output constantly overshoots or undershoots what the grid needs. The more wind turbines and solar panels you build, the larger the collective swings become because output doesn’t average out, it moves together. Many sites share the same weather, which makes their fluctuations correlated and amplifies total variability.

As variability rises, the system needs more reserves and redispatch to stay balanced. Each of those fixes adds complexity and every layer of complexity multiplies the number of things that can go wrong. The grid becomes a feedback loop: more intermittency creates more volatility, which demands more intervention, which adds more volatility still. That’s how costs accelerate. The process is already underway.

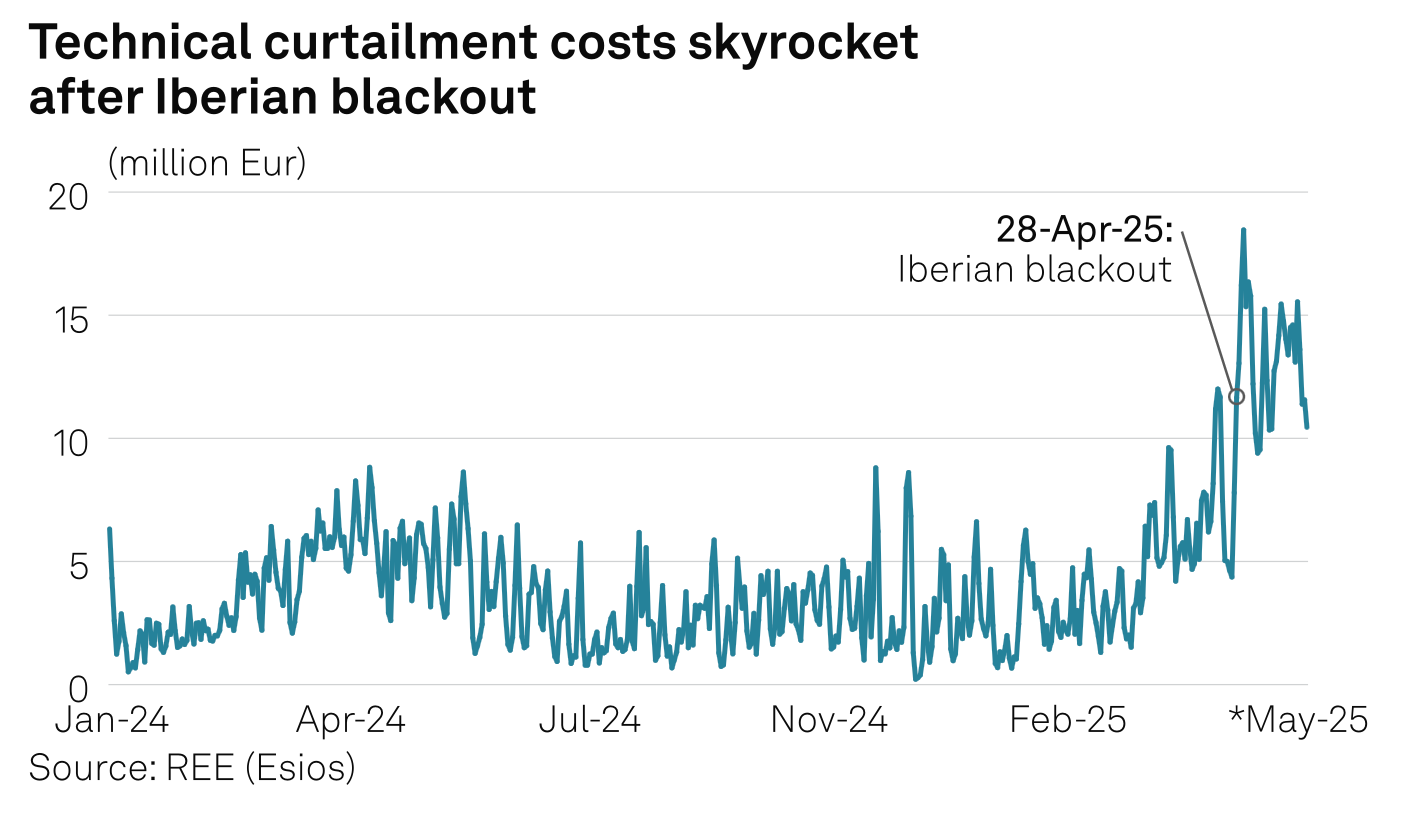

Take Spain. The blackout on April 28 changed how the grid was run. Operator REE started to manage the system with a new level of caution: curtailing solar output earlier, ramping gas plants more often, and holding bigger reserve margins to keep frequency stable.

As a result, technical curtailment costs jumped from roughly €3.5 million a day in early 2025 to over €18 million in early May. That’s what happens when you replace a system designed for reliability with one where reliability is an add-on you have to purchase separately.

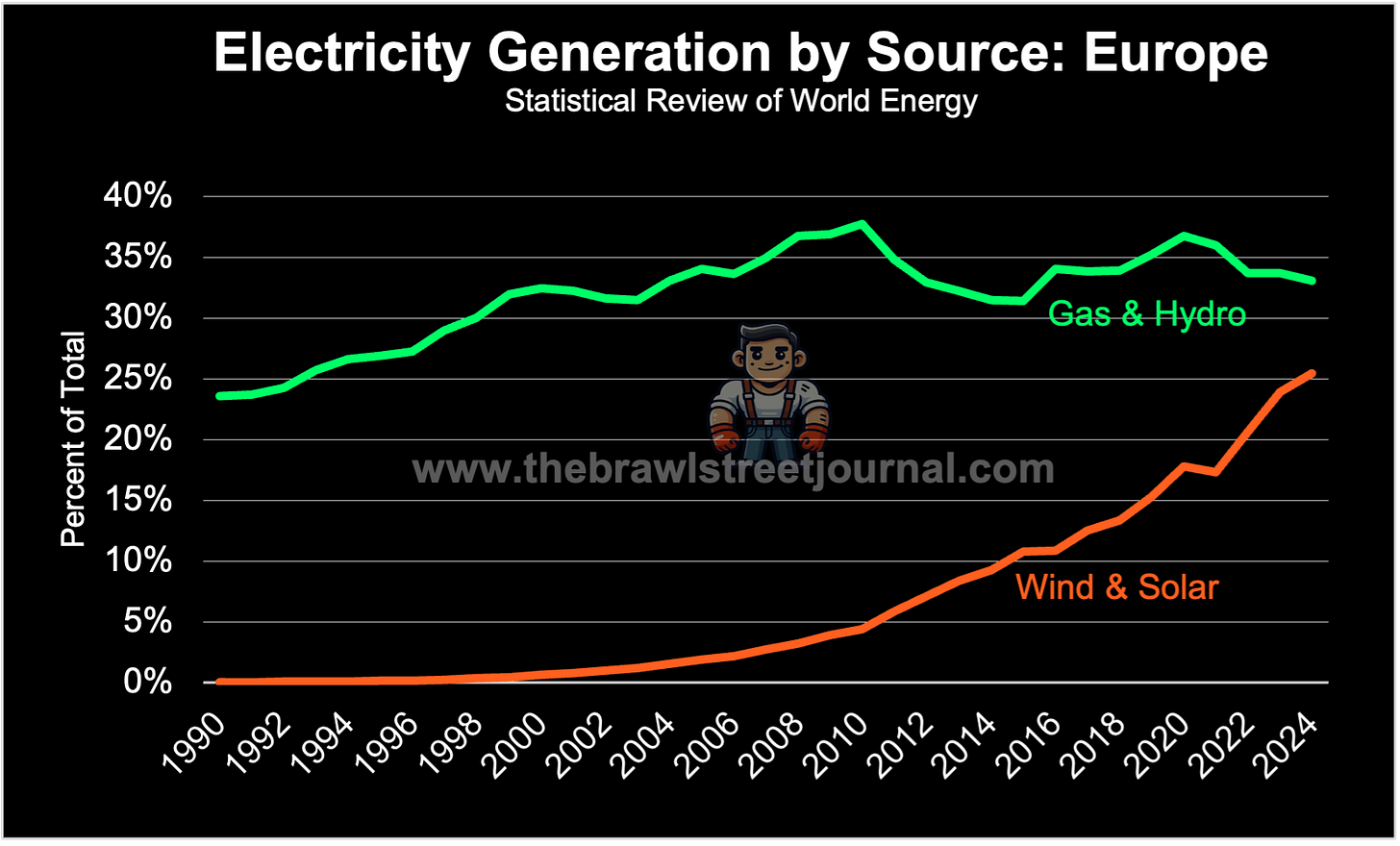

The same mechanism played out more violently in Germany during the last decade. In 2013, its grid carried roughly 70 gigawatts of combined wind and solar capacity. By 2024, that figure had more than doubled to 163 gigawatts, according to the Statistical Review of World Energy. The annual bill for grid interventions didn’t just double, it exploded 16-fold: from €176 million in 2013—€132.6 million in redispatch plus €43.7 million in feed-in management—to €2.8 billion in 2024.

To be clear: due to regulatory changes, the numbers from 2013 and 2024 don’t map exactly one-to-one. Various mechanisms have been integrated under the Redispatch 2.0 congestion-management regime. Still, the direction is correct: costs have multiplied many times over as generation capacity roughly doubled. Europe may have seen nothing yet though. Because in the next few years it’s about to cross a dangerous threshold.

For now, dispatchable gas and hydro capacity still outweigh intermittent sources, keeping a lid on volatility. But Europe is on track to reverse that balance:

A grid dominated by the weather will need endless, expensive patchwork: synthetic inertia to replace the spinning mass of retired turbines, and “shadow capacity” that must sit idle most of the time and ramp up only when the wind dies or clouds roll in.

To address this, the German Federal Network Agency has launched a market for inertia, while Economy Minister Katharina Reiche is preparing a capacity market to finance new dispatchable generation that will mostly stand by, waiting. Grid expansion, storage, and interconnectors add further layers of cost and complexity.

According to a recent study by the German Chamber of Commerce and Industry, annual investment in the energy, industry, building, and transport sectors would have to more than double if current energy policies were to continue: from an average of around €82 billion between 2020 and 2024 to somewhere between €113 billion to €316 billion in 2035. Early transition models had projected a fraction of that. The non-linear curve has become unmistakable.

And this isn’t a hill you climb once and move on from. By the mid-2030s, a significant portion of Europe’s wind and solar capacity will need replacing. Turbines and panels wear out after about twenty years. Batteries used for storage and synthetic inertia after about ten. A forever subscription to China. The grid balancing costs stay too.

Yet earlier this year, the European Commission boasted the EU would reduce fossil-fuel spending by €45 billion in 2025 thanks to its energy policy—a number so small in comparison to past and future climate spending, it reads like satire.

Of course, things that can’t go on forever don’t. Before this transition can run its full course, Europe will run out of fiscal room to fund it, a trajectory already foreshadowed by France. As debt service climbs and tax revenues fall, there’s less space for grand experiments with rising cost curves.

Europe has seen what happens when the money runs out. In Greece, austerity protests filled the streets, and no government is willing to risk its survival like that again. Long before reaching that point, leaders will slash climate subsidies and abandon the vanity metric of installed capacity. With the private sector buckling under bankruptcies, there’s no one left to fund the illusion.

The charade might limp on for a while with postponed targets and renamed subsidies. But the trajectory is fixed. The energy transition is a dead man walking.

That doesn’t change the climate targets set at the EU level. As a result, the Commission could push member states to meet those goals even as they run out of fiscal room—if deindustrialization hasn’t done the job first, and if the Commission even lasts that long.

Because confronted by hostile politics and empty coffers, the Union has bigger problems than the climate. It survives only by the authority its members grant it, and with anti-EU parties on the rise, that authority is eroding fast. Keep pushing ideology over solvency, and the collapse will devour the project itself.

Share this with anyone who still thinks the grid doesn’t shape politics!

📨 People in boardrooms, energy desks, and hedge funds keep forwarding this. Stop getting it late — subscribe now!

Already subscribed? Thanks for helping make BSJ quietly viral.

Ironically, the economic contraction & de-industrialization is delaying the final act of the Transition collapse. Germany is back to 2005 levels of industrial output.

It is beyond parody that the likes of UVDL continue to harp on about "the science is clear" and "renewables are the future", an almost comical embodiment of incompetence and stupidity. The sad thing is that, like Soviet Russia of old, Soviet Europe will survive much longer than we think and will do untold damage before it finally is relegated to the ash heap of history

This article precisely conveys what I am trying to say.