Nord Stream 2 is back. Not just as a pipeline, but as a wedge that could split Europe itself. At the center of it all is a ruling from the Cantonal Court in Zug, Switzerland. Before we dive into the details, a quick recap:

On January 9, 2025, the Zug court froze the bankruptcy proceedings for Nord Stream 2 AG (NS 2 AG), the Swiss-based operator wholly owned by Gazprom. The court cited political sensitivity and reported outside investor interest as grounds to pause the process, giving Gazprom and unnamed backers more time to position themselves. I wrote about that legal maneuvering back in March:

The moment investors start bidding, the truth comes out. If NS2 were to go up for sale, you’d see the market—not politicians—decide what it’s really worth. If NS2 were truly a stranded, unsalvageable asset, Gazprom wouldn’t be fighting to stop an auction. It would let the bankruptcy process run its course. To prevent all of this, Gazprom and NS2 AG stalled the process to cut a private deal instead.

On April 30, they reached this private deal: Last Friday, the Swiss court announced it had officially approved a debt settlement (Dividendenvergleich) between NS 2 AG and its creditors—ENGIE, OMV, Shell, Uniper, and Wintershall.

While the decision hasn’t been made public, the court’s press release indicates: The creditors have agreed to accept a partial payout, likely just a fraction of the €10 billion sunk into building the pipeline. Their concession allows NS 2 AG to stay afloat, avoiding a public auction.

At the same time, small-scale creditors appear to have been paid off in full. The court’s decision can still be appealed, but since all potential appellants must’ve been part of the deal, that’s unlikely.

While no investor has been officially named, this debt settlement suggests outside money has entered the game, providing enough capital to keep the company alive. And whoever injected that fresh money almost certainly did so with the intent to gain control over the pipeline.

How The Game Begins

There are two possible ways to do that: Either by acquiring NS 2 AG from Gazprom in a share deal, or by purchasing the pipeline infrastructure directly in an asset sale. The settlement sets the stage for the next move: a transaction along one of those two paths.

In both a share deal and an asset sale, the pipeline’s technical permits would transfer with the infrastructure. What wouldn’t transfer, because it never existed, is the operator certification.

This certification is the legal approval required under the EU energy regime for any pipeline to inject gas into the EU market. Nord Stream 2 never received this certification, as Berlin froze the process in early 2022, shortly before Russia’s full-scale invasion of Ukraine. Any new owner will still need to secure this certification before the pipeline can legally operate. And that’s where the political fight begins.

👀 Reading this from a forwarded email? You’re missing critical insights while others act faster. Subscribe to The Brawl Street Journal, it’s free…

Sanctioning a Ghost?

Kyiv’s European allies have just renewed their opposition to the pipeline. They’re threatening new sanctions against Russia, including a permanent ban on Nord Stream 2, if the Kremlin refuses to accept President Trump’s proposed 30-day ceasefire in Ukraine.

Banning a pipeline that has never been certified and can’t be used anyway seems like an odd choice. But it doesn’t end here. Brussels also escalated its long-term energy strategy by detailing plans to ban Russian gas imports by 2027.

In that scenario, Nord Stream 2 should be irrelevant anyway. One explanation for the EU’s behavior is that it’s a negotiation tactic: a way to escalate early, with the option to soften later in exchange for bigger concessions at the negotiating table.

That’s a plausible theory. However, it runs into one problem: Both Ursula von der Leyen and Friedrich Merz, the two most vocal characters of Europe’s hard line against Russia, have shown no sign of softening. Of course, politics can shift fast. But the real issue is what Eastern EU member states demand. That’s where the wedge comes in.

Eastern Pain, Western Policy

Several Central and Eastern European countries—Slovakia, Hungary, Romania, Bulgaria, and the Czech Republic—continue to rely directly or indirectly on Russian gas. They have made it clear they want to keep that option open. Slovakia’s prime minister recently called the EU’s proposed blanket ban on Russian gas “economic suicide.”

These member states have a point. Limiting your supplier base isn’t diversification. It’s just swapping one dependency for another. From Russia to the U.S. or Qatar.

There’s also a legal angle: the EU’s principle of “energy solidarity” is binding law. In 2021, the European Court of Justice ruled that EU institutions must take into account the security of supply risks faced by member states when adopting energy policy. That decision struck down a regulatory exemption that had benefited Gazprom, precisely because it endangered Poland’s energy security.

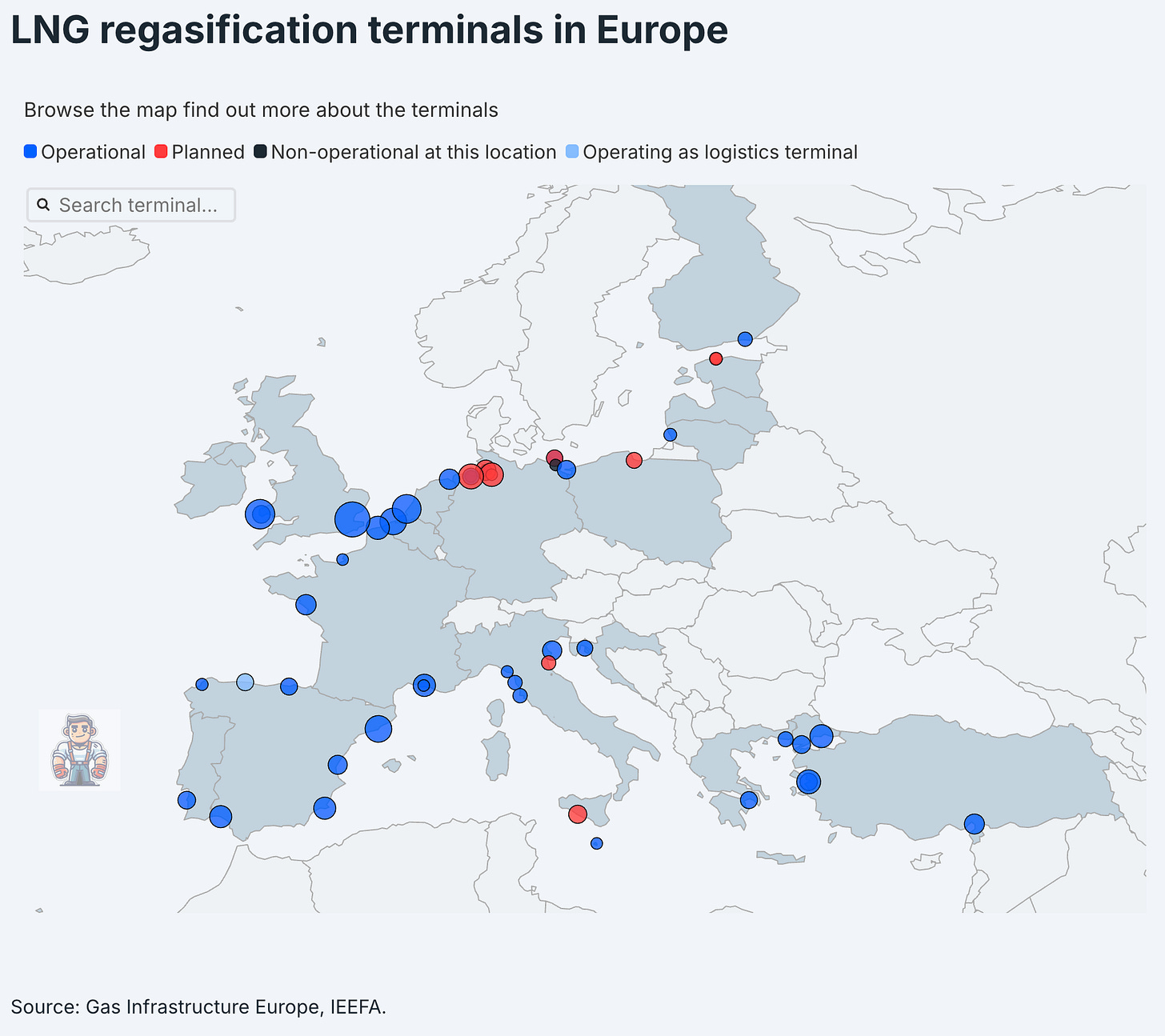

The East’s position is rooted in geography and infrastructure. Western Europe has already built the LNG import terminals and diversified its gas sources. But the East doesn’t have comparable import capacity. A blanket gas ban risks imposing disproportionate economic pain on countries that don’t have access to alternative supplies.

The Commission’s “Roadmap towards ending Russian energy imports” offers no concrete replacement guarantees, just aspirational targets and generic timelines. That makes Nord Stream 2 more than a stranded asset. It makes it a pressure point and potentially a bargaining chip in a much larger game of intra-EU leverage.

Because there’s an underappreciated wrinkle to the Nord Stream 2 story: the pipeline ends in Greifswald, Germany, but connects directly to the OPAL and EUGAL pipelines into Eastern Europe. The implications are significant.

From Pipeline to Propaganda Tool

Germany can refuse to buy Russian gas and still allow it to flow through its territory toward Eastern Europe. This is the angle Russia could exploit.

By insisting that Nord Stream 2 be revived as part of a larger peace deal, the Kremlin could reframe the situation entirely. If Berlin or Brussels push back, Russia can position itself as the party offering a resolution, one that is being blocked by the West. Suddenly, it’s no longer Moscow rejecting peace, but the EU and Germany standing in the way of ending a years-long war.

Would that make economic sense? Not necessarily. Post-war, gas volumes could likely be covered by existing infrastructure through Ukraine and Poland (via the Yamal pipeline). However, public narratives are not shaped by capacity projections or infrastructure maps but by simplicity and emotional resonance. And that’s what makes this moment so dangerous for Europe.

Europe Cracks

Eastern European member states could argue that the EU is pursuing its moral crusade at their economic expense, while Western states enjoy secure LNG access from Qatar and the United States.

If gas prices were to rise sharply in Eastern Europe, the political cost could be severe. When the economic pain feels one-sided, calls for solidarity begin to sound hollow, and anti-EU sentiment can turn quickly into fragmentation pressure.

All of this, of course, is perfectly obvious to the Kremlin. It morphs Nord Stream 2 into a psychological lever capable of dividing Europe from within.

And what about the United States? Given Trump’s prior resistance to the project, it may seem inconsistent that he now appears to support a U.S. investor’s interest in the pipeline.

Welcome to the Family

When a Zero Hedge reporter recently asked Trump in the White House whether he knew who sabotaged the pipeline, he responded:

I think a lot of people know who blew it up, but I was the one who blew it up originally because I wouldn't let it be built, and then when Biden got in he allowed it to be built.

It’s easy to dismiss that as the erratic rambling of a provocateur. But it only sounds that way if your time horizon ends at next winter’s gas storage targets.

As analyst

observed, we now live in a “La Cosa Nostra Americana” order of global politics, a world where U.S. protection is conditional on one thing: loyalty. You’re either in the family, or you’re not. And what better way to remind an ally of that loyalty than by placing your finger on one of its most strategic arteries?Self-Sabotage Disguised as Strategy

Friedrich Merz and Ursula von der Leyen know that Nord Stream 2 is back on the board. Their sudden push to “sanction” a supposedly dead pipeline is best understood as a preemptive move. As clumsy as this maneuver may appear, it signals that Berlin and Brussels understand the strategic threat Nord Stream 2 still represents.

Once again, though, Germany’s posture is strikingly self-defeating. State-owned Uniper invested €1 billion in building the pipeline. With the debt settlement in Zug, that billion is likely gone for good.

Uniper also holds a $13 billion arbitration award against Gazprom, covering the undelivered gas volumes and the emergency spot-market purchases it was forced to make after Russia cut off supply in 2022. But as things stand, Uniper may never collect a cent.

Don’t Touch The Pipe

Gazprom owns NS 2 AG, but that doesn’t make the pipeline company liable for Gazprom’s debts. Creditors can’t pierce the corporate veil and seize the subsidiary’s assets, unless a court grants an extraordinary remedy.

And if the pipeline ends up sold in an asset deal, things get even worse for Uniper. The infrastructure itself would be carved out, and NS 2 AG’s liabilities would stay behind, attached to a hollowed-out legal shell. Any outside investor buying the pipeline will ensure they’re not on the hook for the parent company’s debt.

So what’s Uniper’s best shot at recovering any of that $13 billion? Offsetting the claim against future gas deliveries from Gazprom. But that’s precisely what Berlin is determined to avoid.

Nord Stream 2 may not deliver gas again any time soon. But the way Europe handles it could determine who holds the real power in the next phase of the war, and in the fragile peace that may follow. Berlin is backing a strategy that may result in sacrificing billions, while preemptively giving up leverage in any future settlement. This is strategic self-harm dressed up as moral clarity.

Send this to the last person who said Nord Stream 2 is underwater!

People in boardrooms, energy desks, and hedge funds keep forwarding this. Stop getting it late — subscribe now!

Already subscribed? Thanks for helping make BSJ quietly viral.

Classic move, to flip it against the saboteurs.

Not today fine a point, but is 2A still flooded with sea water? It's a carbon still pipe, generally salt water and,steel don't mix well. Yes the pipes have an internal epoxy coating, but it's intended for gas.