In the early 1960s, Ulsan was just a fishing village. A quiet, coastal town in South Korea, not even an afterthought in the global economy. At that time, South Korea was one of the poorest countries in the world, with per capita income lower than Haiti, Ethiopia, and Yemen.

The only thing the country seemingly had to offer was cheap labor. But South Korea’s leaders understood that if they wanted to transform their country into an industrial powerhouse, that wouldn’t be enough. To compete with Japan, they needed a long-term energy strategy that could power heavy industry at scale.

As a research paper explains:

The government vigorously facilitated the building of large-scale energy facilities centered on oil refineries, coal, and nuclear power plants by authorizing massive finance measures including foreign loans, grants, and tax incentives.

It worked. New factories stretched across the skyline. Ports filled with Hyundai ships. In the 1970s, Ulsan wasn’t just producing at scale, it was flooding global markets. Ulsan went from a fishing village to an industrial powerhouse.

The same companies that had started in Ulsan were no longer just competing with Japanese firms. They were overtaking them. Today, South Korean companies have surpassed their Japanese counterparts.

Hyundai, which started making cars in Ulsan in 1967, overtook Honda in global car sales. Hyundai Heavy Industries, launched in 1972, surpassed Mitsubishi Heavy Industries to become the world’s largest shipbuilder. And Samsung crushed Sony in electronics.

For years, Japan had seen South Korea as a second-tier economy, useful for outsourcing, but never a real competitor. Then, suddenly, South Korea wasn’t just catching up, it was winning.

Right now, a similar story is playing out in Europe.

Poland Is Ready to Take Over

Germany still sees itself as the industrial center of Europe. It has been for decades. It has the strongest manufacturing base, the most advanced factories, the biggest global brands.

But beneath the surface, the engine is breaking down. Factories are relocating. Energy costs are skyrocketing. Bureaucracy is choking growth.

And just across the border, a new power is rising.

When Poland joined the EU in 2004, millions of Polish workers left for Germany and the UK. They took low-wage jobs in factories, construction, and logistics. To Germany, Poland was useful but never important.

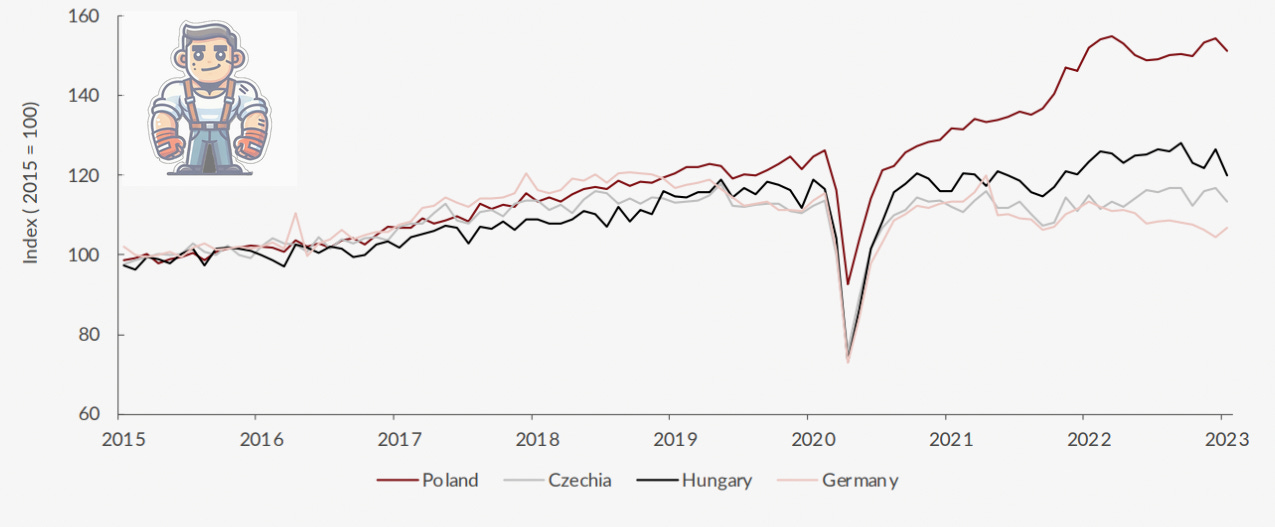

But over the past decade, foreign investment has been pouring into Poland. Mercedes, Bosch, MAN, and other German giants are moving production there. Poland’s economy expanded by 2.9% in 2024 while Germany’s was contracting. And Poland’s industrial production is growing while Germany’s knows only one way: down.

As Germany struggles with high energy costs and deindustrialization, Poland is laying the groundwork for an economic leap forward, just like Ulsan did in the 1960s.

Because back then South Korea Ulsan didn’t just industrialize: it switched to denser energy sources. That was the foundation for South Korea’s rise. Now, Poland is making the same kind of shift.

And just like South Korea had the backing of the U.S., Poland is locking in a strategic partnership with America. This is the story that got drowned out by all the noise surrounding the recent Trump turmoil. But over the next decade, it could reshape the balance of power in Europe. Let’s shed some light on it.

Energy Density or Economic Death

No industrial power rises without a stable, affordable energy supply. And throughout history, that has always meant one thing: moving toward denser energy sources.

Technological progress has consistently increased the energy density of fuels:

• Wood: 16 MJ/kg

• Coal: 24 MJ/kg

• Oil: 44 MJ/kg

• Natural Gas: 55 MJ/kg

• Nuclear Power: 3,900,000 MJ/kg

An economy that relies on low-density energy sources like renewables cannot compete with one powered by high-density fuels. It doesn’t matter that wind and sunshine are “free.” Without concentration, they can’t sustain industrial growth.

As

recently put it, “There’s much more thermal energy in a swimming pool than there is in an egg pan of boiling water.” Yet, the energy density makes all the difference. You can leave an egg in a swimming pool the entire day and it will still be raw.Germany once understood this. It built its industrial dominance on dense energy sources. But it threw that advantage away. It shut down its nuclear reactors, insisted it could do without cheap Russian gas, and now faces some of the highest industrial electricity prices in the world.

Poland is going the opposite route.

Today, Poland still relies heavily on coal, which accounted for 70.6% of its electricity production in 2022, according to the Energy Market Agency (ARE). But that’s about to change. Poland plans to phase out coal almost entirely by 2040. And instead of repeating Germany’s mistakes, it is locking in long-term, high-density energy sources.

At the center of this transformation is Poland’s plan to build its first-ever nuclear power plants, with a total capacity of 6-9 GW. The first facility, planned for Lubiatowo-Kopalino on the Baltic coast, will use three Westinghouse AP1000 reactors. The goal is for the first reactor to come online by 2033 with an output of 1.25 GW. A second plant, likely to be built in central Poland, will add more capacity.

Nuclear power is set to secure Poland’s long-term energy independence, reducing reliance on coal, gas, and oil imports while stabilizing prices. Unlike coal or gas, nuclear fuel is far less susceptible to price fluctuations, making it easier to secure long-term supply contracts and predict electricity costs. In fact, fuel expenses account for only about 10% of nuclear power’s overall cost, ensuring greater price stability for decades to come.

But this isn’t just a Polish initiative. It has direct U.S. backing.

America’s Next Power Play

In November 2024, the U.S. International Development Finance Corporation (DFC) has signed a letter of interest for a $980 million investment in Poland’s nuclear project.

As Agnes Dasewicz, DFC’s head of investments at that time said:

DFC is dedicated to enhancing energy security across Central and Eastern Europe. Our involvement here aims to reduce dependence on Russian energy while simultaneously promoting economic growth and job creation.

Dasewicz is no longer at the DFC. And you can bet that Trump has replaced every senior official appointed under Biden. But here’s the thing: Trump created the DFC in the first place. Established in 2019, the DFC was specifically designed to counter China’s Belt & Road Initiative by financing strategic infrastructure projects in key regions. And now, the Trump administration is doubling down on that approach, shifting USAID funding into the DFC to increase private-sector involvement in economic diplomacy.

As Bloomberg explains:

The new approach would see reduced humanitarian assistance and a greater role for private equity groups, hedge funds and other investors in projecting economic might as the US competes for influence and strategic projects overseas with China.

If Washington pulls back, Beijing could step in. Hungary has already made its decision: it’s pushing ahead with the Russian-built Paks II Nuclear Power Plant, with Rosatom as the main contractor. Poland, for obvious reasons, won’t be turning to Moscow. But if the U.S. abandons the project, it wouldn’t be unthinkable for Poland to turn to China. That’s why it’s unlikely Washington will walk away from its DFC funding plans. This isn’t just about Poland’s energy future, it’s about geopolitical leverage in Europe.

And the DFC isn’t the only U.S. funding source backing Poland’s nuclear expansion. The U.S. Export-Import Bank (Exim Bank) has also pledged $17.62 billion in financing for the Lubiatowo-Kopalino nuclear power plant project.

Nuclear Funding as the Carrot

The U.S.-Poland relationship isn’t without friction. In January 2025, the outgoing Biden administration imposed a cap on the number of AI chips Poland (along with 17 other EU countries) could purchase from the U.S. Trump has taken office, but he hasn’t reversed that decision.

The backlash in Poland was immediate. But when it happened, I pointed out what the media ignored: every EU member hit by the restriction has ties to China’s Belt & Road Initiative. That connection should have been obvious. Yet somehow, the mainstream press missed it.

The U.S. strategy is clear: AI chips are the stick, and nuclear funding is the carrot. Washington isn’t just investing in Poland’s energy sector, it’s using it as leverage to pull Poland further from China’s orbit.

Of course, even with U.S. backing, pulling this off won’t be easy.

Nuclear power plant projects are notoriously complex. They are often delayed, run over budget, and require highly specialized expertise. Staffing is a particularly urgent challenge. As a report by law firm Baker McKenzie points out:

The possibility of meeting the staffing needs associated with the development of nuclear energy is well beyond the perspective of a few years. In the Polish case, this is due not only to the need to educate specialists, but also to the construction of an almost entire system for their education […] In the initial phase of nuclear power development in Poland, a large part of the workforce is likely to be made up of people from other countries.

Another regulatory hurdle is Poland’s need to comply with EU state aid rules.

However, the markets seem confident that Poland will be able to pull off its broader energy independence strategy.

Density Always Wins

In January 2025, Polish state energy giant Orlen raised $1.25 billion in its first-ever bond issue on the North American market. Demand was overwhelming—the bonds were three times oversubscribed.

A portion of the proceeds is earmarked for at least two small-scale nuclear power plants, reinforcing Poland’s commitment to long-term energy security.

Poland is standing at a crossroads.

If it executes, it won’t just secure energy independence. It will cement itself as Europe’s next industrial powerhouse. A country that was once dismissed as a low-cost supplier will leapfrog its old economic partners, just as South Korea once did in Asia. For now, the trend lines are clear. Investment is pouring in. Factories are moving. The energy strategy is in place.

Germany once dictated the industrial order in Europe. But in a world where cheap, reliable energy is power, Poland is making the smarter bet. Nuclear is the industrial backbone that Germany abandoned. Now, Poland is claiming it. With U.S. backing, Poland isn’t just catching up: it’s positioning itself to inherit the future Germany left behind.

Germany may try to course-correct. But by the time it does, Poland could already be too far ahead. Its rise won’t just reshape Europe—it will prove that energy policy isn’t just an economic decision. It’s a civilization-defining one. Density wins. Those who ignore it lose. Every time.

Know someone who still believes Germany will turn this around? Share this with them!

Great article.

If you are correct and Poland is the next powerhouse in Europe, then a country ETF might be interesting. I just took a quick look at the country ETF iShares MSCI Poland ETF (EPOL). The P/E ratio is just shy of 13. Looks attractive. I also like that Poland still has its own currency vs. being part of the Euro. I added Poland to my research list.

On a side note, I have been to Germany, Japan, and South Korea many times (not yet to Poland), and I have seen it first-hand what you wrote about. Japan and Germany remind me (sadly - as I like both countries) of the old quote, "Success can lead to complacency, and complacency is the greatest enemy of success."

Polish rise to prominence, in some respects, is a story of a country that is rising in spite of, not necessarily because, of government intervention. It must be stated that for decades, Polish economy was driven by foreign investment, largely because of lack of national champions that had sufficient capital of their own to power themselves above the foreign competition - something that an aggressive industrial policy of S.K achieved ( a lot of state industries were sold on the cheap in the 1990s, and it was seen as a betrayal of the national industrial policy for a long time in Poland). However, through integration with Western markets, Poland was able to leverage its highly skilled population to grow these businesses. Orlen is now a flagship business for the country's energy sector, and a largest company of its sector in Central/Eastern Europe. CD Project is a strong cultural and digital presence as well, and a multitude of niche white goods manufacturers that are benefitting from a gap in Western Europe's own manufacturing of this kind. Addition of logistic hubs, IT and Polish ability to work in Western economies without a hitch mean that Poland is perhaps close to an end of history of catching up that dogged its existence in the past several centuries.

The geopolitical alignment with America is a sheer necessity, where Western Europe is both unwilling and unable to support Polish ambitions to the degree that the current trajectory of the country demands. I am somewhat reluctant on this connection, but in absence of other geopolitical partners that are willing to let Poland expand (Germany was never keen on it, French attitudes have always been mercurial and Russia as a partner is a conversation of a different kind, if even feasible), the Atlantic connection is the only one that will allow the country to assert itself and perhaps, continue to take on leading role on the Continent. Who knows, maybe the renaissance of Europe as a power will happen under leadership of Warsaw? An amusing prospect for now, but not unrealistic with passing of time.